Rate cut, economy and growth

The latest consecutive two interest rate cuts in Australia does not necessarily project a gloomy future of the world economy and of Australia itself. It’s not just in Australia. Since the global financial crisis, central banks around the world have cut interest rates 716 times and purchased $1.25 trillions worth of bonds trying to avoid another crash.

We haven’t seen a story of any improvement. Despite push by Federal Reserve in the US for last two years, there are hardly any positive results. Fed’s continued push to stimulate the economy through interest rate rise potentially fired back. Economy did not improved as expected. It may look at cutting again than going upward.

The rate cut in Australia was long expected with a section of economic hypothesis-ts claiming it will help growth. They presume the rate cut boost spending and accelerate growth. Not necessarily. The only beneficiary of the rate cut are the home buyers. The banks have not touched their business and personal lending books which are generally are engines to boost spending and help economy grow.

The Japanese and European banks operate in zero interest rate. And they have already demonstrated their inability to shake the stagnant growth. Australia may not be in that desperate situation to follow their suit. It has obligation to look into alternatives.

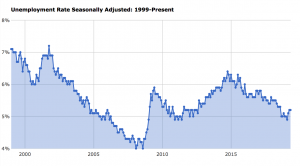

Today’s fundamental problem of economy is lack of income growth – wage growth and employment. Australia has currently unemployment rate of 5.2% and those looking for alternative jobs continue to rise. More people seek alternative jobs due to sluggish wage growth which averaged at 2% in the last 12 months. Without wage growth, spending is impossible.

RBA Governor Philip Lowe has urged the government to increase more spending through infrastructure projects. More spending is expected to create jobs, increase spending and improve growth. The Australian economic growth now remains the lowest since GFC.

In fact, the government has to look for other paths than monetary easing. The benefits of rate cuts are not evenly distributed across the community and this condition does not necessarily fuel growth. The reason is growing concentration of wealth. Fairer way for wider distribution of wealth is the alternative to economic growth.

Economists are still stubborn to their traditional push which is more likely to invite another crash.